Real Estate – Tax Benefit Guide – includes the most recent up-to-date 12/18/2015 PATH Act 2015 provisions (Protecting Americans from Tax Hikes).

Imagine purchasing your home, enjoying pride of ownership and creating priceless fond memories. The American Dream of owning your own home also includes some real measurable benefits that over time could increase your net worth and be a wealth builder via equity build-up, rental income, appreciation and tax benefits.

Here we will explore tax benefits of owning real estate.

These real estate tax benefits apply anywhere in the United States (except a few extra Hawaii State specific tax benefits), regardless of your local market conditions. The enclosed sample calculations use typical Honolulu property values that could be high, or low, compared to home values in your part of the country. Some of the numbers may need to be adjusted to fit your individual situation or your specific local real estate market.

Taxes are hard to understand and calculate. Tax laws can change quickly. Often additional restrictions apply. Therefore always verify with your favorite qualified tax professional how you can best benefit from current tax laws.

Our goal is to inspire further research and to help you prosper with making wise real estate investment decisions, so that you may benefit from this new knowledge for the rest of your life.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Tax benefits fall into the following four basic categories:

a.) Tax Deductions are expenses that are deductible against your taxable income, thus reducing your taxable income. The tax deductions’ value depends on the taxpayer’s marginal tax rate.

b.) Tax Credits are applied directly against your tax liability dollar-for-dollar, thus are more valuable than deductions in reducing your tax liability. Tax credits have the same dollar value for all taxpayers where the tax liability is equal or greater than the credit.

c.) Tax Exemptions reduce or eliminate certain tax obligations, means being free from, or not subject to taxation.

d.) Tax Deferral allows taxpayers to delay tax payments until a later time.

The actual usage of your property will make a big difference on the type and amount of tax benefits available to you. To understand the differences, you should probably read both: Part 1 and Part 2, regardless if you are 1.) an owner occupant – using the property primarily for your personal enjoyment, or, 2.) a real estate investor – using the property primarily as investment to generate rental income. The dividing line can get rather thin between both categories. Sometimes a personal home gets turned into an investment property and vice versa. Small changes in property use can have a big impact on your tax bill and the financial end result. Let’s get started with Part 1.

Part 1: Owner Occupant Tax Benefits

These tax benefits are available when you use your property for your personal enjoyment. Qualifying properties are your main home, aka primary or principal residence (where you live most of the time), and your other personal residences, e.g. a 2nd home, or your personal vacation home, as long as it is not rented for more than 14 nights max.

As an owner occupant, you get to deduct the following three well known expenses on your annual US federal tax return on Schedule ‘A’, itemized deductions:

1.) Mortgage Interest Deduction: You get to deduct mortgage interest paid during the tax year, on mortgage loans up to $1Mill. In addition you get to deduct ‘Home Equity Line Of Credit’ (HELOC) interest paid during the tax year on loans up to $100K. That is a whopping mortgage interest deduction of up to $1.1Mill in total mortgage debt. Not everyone has $1.1Mill in mortgage debt, but if you do, you would be able to deduct about $46,391 (with a 30y fixed @ 4.25% jumbo rate) lowering your taxable income by the same amount during the first year of ownership.

You may also deduct any mortgage late payment fees (if any) and any mortgage prepayment penalty in the tax year paid.

2.) Property Tax Deduction: You get to deduct all property taxes in the tax year paid.

3.) Mortgage Points Deduction: You get to deduct the upfront cost to obtain a purchase mortgage loan, aka mortgage points for the purchase of your main home, in the tax year paid.

However, when you purchase a second home, not your main home, you may not deduct mortgage points in the year paid, instead you must deduct them spread out over the life of the loan. Points paid to refinance your mortgage (regardless if your primary or 2nd home) are also deductible over the life of the loan.

Sample tax calculation for an owner occupant purchasing a 2-bedr, 2-bath Honolulu condo:

A typical 2-bedr Honolulu condo for sale would cost about $650,000. An 80/10/10 owner occupant loan program requires 10%, or $65K cash down payment. The remaining $585K financed at 4% will cost $2,793/mo (principal and interest). You might also have to pay $636/mo maintenance fee (not tax deductible), and $195/mo property tax (tax deductible). To obtain the mortgage loan you might pay 1 mortgage point (1% of loan amount = $5,850) upfront loan funding fee at closing (tax deductible).

Total payments when purchasing: $3,624/mo (principal & interest & maint. & prop tax), or $43,488 a year, before tax deductions. Let’s not forget the one-time $5,850 loan funding fee.

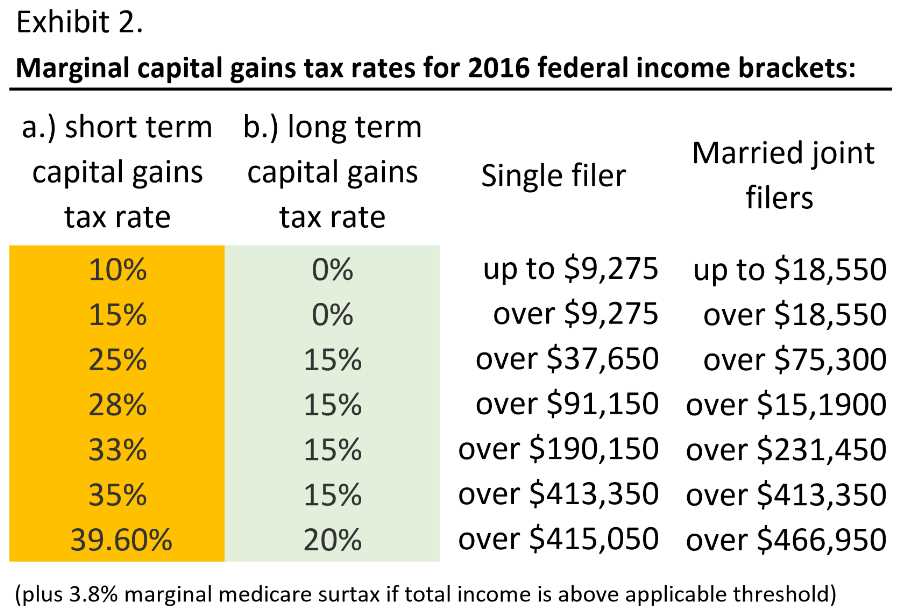

Whether you know it or not, many of us easily pay a combined 30% or more in federal and state taxes (check Exhibit 2. in Part 2. below). For simplicity we use the 30% bracket to calculate the tax savings on the three deductible expenses mentioned above. The simple formula is: Deductible expense x 30% = actual $ tax savings.

Exhibit 1. – The buyer in this scenario realizes $9,421 in tax savings in the 1st year (full 12 months), and $7,540 in the 2nd year. The purpose of this blog post is simply to show the often overlooked tax savings. In a future blog post we will explore the long term financial implications of leveraging with only 10% cash into Oahu Real Estate appreciating 4.5% annualized over the last 30-years, compared to renting.

Most home owners might be somewhat familiar with the above mentioned 3 deductions. However there is more..

4.) Mortgage Insurance – Tax Deduction: Private mortgage insurance premiums (to protect the lender), as well as FHA, VA and USDA mortgage insurance premiums paid by home buyers have been tax deductible since 2007 as part of the 2006 Tax Relief and Health Care Act. The deducible amount has been subject to an income cap limit starting at $100,000. You are in luck, this provision has been extended again until 12/31/2016.

5.) Home Exemption – Property Tax Exemption: Sorry, this one only applies to Hawaii. – Honolulu County property owners enjoy the lowest property tax rate in the nation: $3.50/y, per $1,000 assessed property value. A Home Exemption reduces your property tax. The exemption amount is deducted from the tax assessed value of your property and you pay property tax only on the lower assessed balance. For your Hawaii principal residence only, you may claim the following home exemptions:

- Standard exemption: $80,000.

- Home owner 65-years and older: $120,000.

- Hansen’s Desease, Blind, Deaf or Totally Disabled: $25,000, in addition to any exemption above.

- Disabled Veterans: Exempted from all property tax, except $300/y minimum property tax.

Note: This tax benefit is Honolulu County specific. Check with your tax adviser on property tax rates and exemptions available in your State / County.

Update Dec 2015: You may qualify for your home exemption on your principal residence even if you are living in temporary accommodations away from your principal residence up to 2-years because of a temporary work assignment, a sabbatical, or if your home was damaged due to natural disaster.

6.) Mortgage Credit Certificate, MCC – Tax Credit: This program is a first-time home buyer tax credit of 15% of your annual mortgage interest. Tax credits provide a dollar-for-dollar reduction against your federal tax liability, and you may still claim the remaining percentage of your mortgage interest tax deduction. The MCC can be applied to Conventional, VA, FHA, and USDA home loans.

7.) First-Time Homebuyer – Penalty Free Retirement Account Withdrawals: The biggest hurdle for first-time home buyers often is the lack of cash funds for a down payment. The IRS allows you to withdraw $10,000, or $20,000 for couples, from your retirement account penalty free for the purchase of your first home. IRA and SEP IRA withdrawal amounts are still taxable. ROTH IRA withdrawals are tax free, but only if you have opened your ROTH IRA more than 5-years ago. Other restrictions apply.

Btw, 401k withdrawals are taxable and do not enjoy the 10% penalty exemption. You could borrow against your 401k, up to half the account value but no more than $50K max. This would be a loan with interest that will need to be paid back.

Note: Before cashing in, or borrowing against your retirement account, carefully evaluate all pros and cons with your favorite qualified professional retirement adviser.

8.) Sec. 25D Renewable Energy – Tax Credit: You may claim a tax credit of 30% of the cost of renewable energy equipment that you install in your home. Qualifying renewal energy systems include solar panels, solar water heaters, geothermal heat pumps, wind turbines and some fuel cell equipment (with limitations). The credit amount is unlimited (!). Any unused tax credit portion exceeding your 2015 tax liability you may roll over to use against your 2016 taxes.

This one is huge! Take advantage of this 30% upfront cost credited dollar for dollar, with a quick return on investment (ROI) for ongoing energy bill savings. The credit has been extended until 12/31/2021 (!), however the 30% credit becomes a 26% credit in 2020, and a 22% credit in its last year 2021.

9.) Sec. 25C Energy Efficiency Improvements – Tax Credit: You may claim a tax credit of 10% of the cost of some energy efficiency improvements to your home. Energy efficiency improvements may include the following: Electric heat pumps; Central AC; some qualified natural gas, propane or oil water heaters and furnaces; insulation and certain insulating roofs reducing heat loss or gain; insulating exterior windows, skylights, or doors, etc. Restrictions apply, including a lifetime credit limit of $500. This provision has been extended until 12/31/2016.

10.) Septic Tank – Tax Credit: In Hawaii, Act 120 allows you to claim up to a $10,000 tax credit for the cost to replace each qualified cesspool with a septic tank, or a connection to the sewer system.

This new tax credit is available effective 1/1/2016 and expires 12/31/2020. There is a $5Mill total cap for each tax year. If you are unable to claim the credit in one tax year, you may claim the credit in subsequent tax years 2017 to 2020.

11.) Home Improvements – Tax Deduction: Any improvements you make to your home are not directly deductible in the year the improvements are done, except as outlined in Sec. 25C, see paragraph 9.) above. (Btw, the interest on home loans, HELOCs, etc. paid for improvements is deductible, as mentioned in paragraph 1.) above). You may however add the cost of these improvements to your cost basis which might diminish your capital gains tax at the time when you sell your home. Make sure to keep accurate records of all your improvement expenses.

12.) Short-Sale Mortgage Debt Forgiveness – Tax Exemption: Distressed home owners selling their home as a ‘short-sale’ are exempt from paying tax on phantom income on the forgiven mortgage debt. This tax relief for homeowners with under water mortgages has been in effect since 2007 and has been extended again until 12/31/2016.

But wait, it gets even better..

13.) Sec. 121 Capital Gains Exclusion – Tax Exemption: Thanks to William Jefferson Clinton’s Taxpayer Relief Act 1997, individual home owners are exempt from paying capital gains tax on up to $250K in gains at time of sale of their principal residence. Married couples are exempt from paying capital gains tax on up to an impressive $500K in gains. Any gains exceeding the maximum exclusion amount are subject to the respective capital gains tax bracket based on your income level (see Exhibit 2. below).

You must have lived in your principal residence for 2 years out of the last 5 years prior to selling. This is an incredible gift horse opportunity and one of the largest most generous tax breaks available to home owners.

Example: Let’s say 5 years ago you and your spouse bought your principal residence for $700K. With a.) some sweat equity, b.) smart value added improvements, and, c.) increased property values the home is now worth $1.2Mill. You and your spouse may sell your home at $1.2Mill without any capital gains taxes due. That is a whopping $500K tax free money you can spend, invest, take a trip around the world, or buy another home and do it all over again. How sweet it is.

A.) You may take this exemption only once every 24 months, but you may take it as often as you like during your lifetime with every principal residence you live in 2 out of 5 years. I personally know clients that have repeatedly used this strategy successfully, bought, renovated and sold habitually every 2 years or so, while substantially adding to their net worth each time.

B.) The 2 out of 5 years living in your home do not have to be the final 2 years, nor do they have to be subsequent years. Means, you are actually allowed to rent out your principal residence up to 3 years after your last use as principal residence and still may claim the tax exemption up to the $250K / $500K capital gains exclusion limit (subject to any depreciation recapture, see further below), as long as the 2 out of 5 year rule is satisfied (Sec. 121 (b)(4)(C)(ii)(I).

C.) If you are an unmarried couple living together in your principal residence 2 out of 5 years and getting married just prior to the sale, you may claim the higher $500K exemption as now married couple at time of sale. Either spouse may own the property but both must have been occupying as principal residence in order to qualify for the higher $500K exemption.

D.) You may claim a partial prorated exemption at time of sale if you occupied your principal residence for less than 2 out of 5 years, provided you have to sell for health reasons, change in employment, or other unforeseen circumstances (Sec. 121 (c)(2)(B).

Example: If you sold due to unforeseen circumstances after only 20 months (instead of 24 months) of use as principal residence, you are exempt from paying capital gains tax on up to $208,333 in gains for a single tax filer (20 : 24 x $250K maximum exclusion = $208,333 prorated exclusion)

E.) If you are a member of the military and you are being deployed, you may still qualify for the full tax exemption even if you do not meet the 2 year use as principal residence requirement.

F.) If your spouse passes away, you may claim the tax exemption up to the full $500K capital gains exclusion limit, provided both of you occupied the home as your principal residence and you sell the home within 2 years of the loss of your spouse. If you wait to sell past 2 years after your spouse passes away, you may claim the exemption only up to the lower $250K capital gains exclusion.

- Rental properties converted into your principal residence for 2 out of 5 years owning. It became a popular tax loophole for wealthy real estate investors to turn their rental property into their primary residence, then sell and claim the capital gains tax exclusion. The 2008 Housing & Economic Recovery Act effective 1/1/2009 closed the loophole and greatly diminished the tax benefit of doing so. The following restrictions apply today:

a.) Sec. 121(d)(6): You may not claim capital gains exemption for any gains realized by way of depreciation since May 6, 1997. (Depreciation recapture is taxed at your ordinary income tax rate, but capped at a top 25% rate, see below par 22.) Sec. 1031 Exchange.)

b.) Sec. 121(b)(4): After January 1, 2009 you may claim the capital gains tax exemption only for the time period you actually used the property as your primary residence. Any time after 1/1/2009, that you did not use the property as your primary residence is considered ‘nonqualifying use’ (except up to 3 years after your last use as primary residence, see C.) above). You may claim the capital gains tax exemption prorated over the holding period only for the years you used the property as your principal residence after 1/1/2009, but you may claim the full capital gains tax exemption for all years you owned the property prior to 2009, even if it was rented (!). Any use prior to 2009, even rental use, does not count as nonqualifying use. (Depreciation recapture tax still does apply).

Example: You bought your home as married couple early Jan 2001 at $300K and sold early Jan 2016 at $700K with a $400K total gain (other than by way of depreciation) over 15 years. (For simplicity closing costs are not calculated). This has been your principal residence from 2001 through 2005 (5 years) and from 2014 through 2015 (2 years), but you did rent out your home from 2006 through 2013 (8 years). You may only claim the capital gains tax exemption for years 2001 through 2008 (8 years, until the law changed) and for years 2014 through 2015 (2 years) for a total of (8+2=) 10 years prorated out of 15 years total holding period. $400K gains : 15 years = $26,667 x 10 years = $266,667 prorated gain exempt from capital gains tax. The remaining $133,333 gain is subject to capital gains tax at the applicable long term tax rate (see Exhibit 2.). Note: Depreciation recapture tax does apply (see par 22.).

- Rental properties converted into your principal residence after a 1031 Exchange.

To mitigate abuse of the Sec. 121 provision by wealthy real estate investors doing 1031 exchanges, the 2004 American Jobs Creation Act further restricts:

c.) Sec. 121(d): If your rental property was part of a 1031 Exchange before turning into your principal residence, you may claim any capital gains tax exemption (subject to the above limitations) only after you held the property 5 years since the 1031 exchange.

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

Home owners have it good, but real estate investors take home the grand price when it comes to tax benefits. Most real estate investors buy properties for the following important reasons:

1.) Cashflow, 2.) Appreciation, and 3.) Tax benefits. – Add to the list 4.) Equity build-up, if you make regular P&I (principal & interest) mortgage payments.

It is the cumulative effect of these 4 factors compounded over time that has created enormous wealth for wise real estate investors. Our goal is to help you discover why investing in US real estate has been favored by many. Here we focus on the multitude of tax benefits for real estate investors. All deductions and credits are against your gross income before your exemptions and standard deductions.

Part 2: Real Estate Investor Tax Benefits

These tax benefits are available when you use your property as an investment. Qualifying properties are other than personal residences, e.g. rental properties generating income. The IRS considers rental property activity a business. Rental income must be reported, but huge tax benefits are available, provided the property is not being used for the owner’s personal enjoyment for more than 14 nights max. Vacation homes where personal enjoyment time exceeds 14 nights or 10% of the number of nights the home is rented, whichever is greater, are considered personal residence and you may not deduct rental loss. You may however still deduct rental expenses, up to the level of rental income, including property taxes and mortgage interest. Restrictions apply. Note: Renting your property to family or friends could jeopardize these tax benefits.

The following 6 tax benefits have already been discussed in Part 1 above, but are also available for real estate investors:

- Mortgage Interest Deduction

- Property Tax Deduction

- Mortgage Points Deduction, deductible only over the life of the loan, rather than deductible in the year paid (as owner occupants are allowed to do).

- Renewable Energy – Tax Credit

- Energy Efficiency – Tax Credit

- Septic Tank – Tax Credit

In addition to these above, the list of tax benefits for real estate investors continues:

1.) Real Property Depreciation – Tax Deduction: This one is huge! Starting from the date your property is ‘placed in service’ ready to be rented, you get to depreciate the value of the improvements over the next 27.5 years for residential investment properties, or 39 years for commercial properties. Improvements means any building or structure, e.g. houses, duplexes, condominiums, apartment buildings, parking garages, mobile homes, storage buildings, but also swimming pools, parking lots, tennis courts, clubhouses, walls, etc. Basically any real property other than the land underneath.

Example: Let’s say you purchase a rental condo for $650,000. The value of the improvements might be $610,000, the value of the land might be $40,000. You get to deduct $22,182 depreciation per full tax year ($610,000 : 27.5y = $22,182) on your federal tax return, until you have completely depreciated the improvement value after 27.5 years. A whopping $610,000 in deductions over 27.5 years, although there never was an actual loss in value.

It gets better. Let’s say your 2-bedroom rental produces $2,550 in monthly rent. Total of $30,600 in annual rental income, minus $22,182 annual depreciation equals $8,418. After your mortgage interest deduction and any other deductions mentioned in this blogpost, your rental property might actually show as ‘paper loss’ on your tax return, lowering your overall tax bill while still enjoying a nice positive cash flow. Means your positive cash flow could be not taxable since offset by the depreciation deduction. Pretty cool, passive income without paying taxes.

To determine the improvement value for your calculation, use the tax assessment record to first establish the ratio between improvement value vs. total value. The tax assessed value might be different than actual market value, or the price you paid, but once you have the correct ratio (improvement value : total value = ratio), than you can calculate the improvement based on your purchase price to use for your real property depreciation.

Remember, as real estate investor you own an asset that over time may increase (appreciate) in value, and you get to depreciate the entire value of improvements on your tax return. Think about it, after 27.5 years, if maintained well, your rental property could possibly produce even more rent and might also be more valuable, even though you have deducted the entire improvement value over the last 27.5 years. What other asset class provides this gigantic dual benefit? How sweet it is to own real estate.

2.) Personal Property Depreciation – Tax Deduction: When purchasing an investment property, some of the inclusions with the sale may be considered personal property rather than real property. Tangible personal property that lasts for more than one year might include appliances, e.g. washer, dryer, refrigerator, stove, dishwasher but also furniture, carpets, and even lawn mowers, etc. used for your rental business. Personal property you may depreciate faster, usually over 5 years rather than over 27.5 years. To depreciate over 5 years the personal property that was included with the real estate purchase, you will need to exclude the cost of these items from the property value basis that you are depreciating over 27.5 years. More on rental property depreciation here.

3.) Repairs – Tax Deduction: All costs for ordinary and necessary repairs and maintenance to your property including the needed supplies you may fully deduct in a single tax year you incurred the cost. Deductible repairs and maintenance may include fixing plumbing leaks, snaking clogged sewer lines, re-painting, replacing broken windows, etc.

The IRS differentiates between repairs – deductible in a single tax year, versus improvements – depreciated over several years. Maximize your allowable deductions by doing repairs instead of improvements.

Note: Although repairs have an immediate tax benefit, repairs don’t necessarily improve the property value. Therefore a repair is still a net expense even after tax deduction. In contrast, capital improvements have two benefits: a.) an increase in property value, and b.) an increased cost basis for a reduced tax bill at time of sale.

4.) Improvements – Tax Deduction: Improvements to the property, rather than repairs, are for the Betterment, Adaptation or Restoration of the property, best to be remembered with the acronym ‘BAR’. Improvements could include additions to the property, replacement or restoration of existing property components, or the adaption of the property to a new or different use. While you may deduct repairs immediately, improvements will need to be depreciated over several years. For example, a roof repair can be fully deducted the same year, vs. a complete roof replacement is an improvement which you may depreciated over time. The length of time to depreciate depends on the useful life expectancy of the improvement, more in IRS Publication 527.

5.) Maintenance & Association Fees – Tax Deduction: All condo maintenance fees and association fees you may fully deduct in the tax year paid.

6.) Property Management – Tax Deduction: A property manager might be charging you to handle the tenant screening, rent collection, check-in and check-out procedures. All property management fees you may fully deduct in the tax year paid.

7.) Cleaning & Maintenance – Tax Deduction: Cleaning and maintenance might include, cleaning fees, pressure washing, yard service, pool service, pest control service, etc. You may fully deduct these in the tax year paid.

8.) Legal & Professional Services – Tax Deduction: Legal and professional services might include attorney fees, eviction costs, accountant fees, tax preparation fees, inspection fees, appraisal fees, real estate consulting fees, etc. You may fully deduct these in the tax year paid.

9.) Utilities – Tax Deduction: If you pay for the property utilities e.g. water, sewer, electricity, internet, etc., you may fully deduct these in the tax year paid.

10.) Insurance – Tax Deduction: You may deduct the insurance premium paid for liability insurance, HO6 policy, RCUP rental condo unit owner policy, fire, flood, hurricane, tornado, earthquake and other property insurance in the tax year paid.

11.) GET & TAT – Tax Deduction: Hawaii State specific, gross rental income received from rental properties on the island of Oahu is subject to 4.5% General Excise Tax (GET). If the rental term is 180 days or less, the gross rent received is subject to an additional 9.25% Transient Accommodation Tax (TAT). All GET & TAT paid on Oahu gross rental income you may fully deduct in the tax year paid.

12.) Lease Rent – Tax Deduction: With Leasehold properties, Leasehold owners make regular monthly ‘ground lease’ rent payments to the land owner. Leasehold rent payments on investment properties might be tax deductible. Purchasing the ‘Fee interest’, means converting the property from Leasehold to Fee Simple, is not tax deductible.

13.) Miscellaneous – Tax Deduction: You may also deduct advertising costs if you advertised your property for rent. You may deduct bank fees for tenant trust accounts, and you may deduct other regular business and office expenses as you would be able to deduct with any small business. After all, rental property activity is a business.

Besides the mortgage interest deduction on loans used to acquire or improve rental property discussed above in Part 1, paragraph 1.), you may also deduct your credit card interest for goods and services used in a rental activity. More on rental property interest deductions here.

14.) Travel expenses – Tax Deduction: As a landlord you may deduct travel expenses to get to your rental property or even the trip to the hardware store to get material for a rental property repair. You may deduct your travel expense either by a.) deducting your actual vehicle expense (gas, repairs maintenance), or, b.) you may use the standard mileage rate deduction. The standard mileage rate changes every year and is currently 57.5 cents/mile for tax year 2015. You must keep accurate records of your miles. More on landlord car expense deductions here, and other restrictions.

15.) Long Distance Travel Expenses – Tax Deduction: As a long distance landlord you may even deduct the cost of your airfare, train or bus fare, rental car, hotel accommodations and even 50% of meals, provided the trip is primarily for your rental activity business. Rental activity business includes dealing with tenants, repairs, improvements, marketing, meeting with real estate attorneys, accountants and real estate professionals. Travel expenses must be ordinary and necessary for you to conduct your rental activity business. Other restrictions apply. Bonus: You may even use your investment property up to 14 nights for personal enjoyment per year, but during your trip, your rental business activity days must outnumber your personal enjoyment days. Make sure you keep impeccable records of all your activities and expenses. More about long distance travel expenses here.

16.) Commercial Leasehold Improvements Accelerated Depreciation – Tax Deduction: You may depreciate qualified non-residential commercial leasehold improvements over an accelerated 15 year cost recovery period, rather than the regular depreciation time table, see paragraph 1.) above. This provision is now permanent with the Dec 2015 tax extender package.

17.) Sec. 179 Real Estate Business Equipment – Tax Deduction: As a landlord and real estate investor, similar to any small business owner, you may immediately deduct new business equipment expenses e.g. computers, software, copiers, cameras, etc. up to a $500K (!) annual limit indexed for inflation, rather than depreciate equipment over several years. To qualify, the business equipment must be brand new, means you are the first owner to place in service. You may deduct these items in the first year regardless if you are a sole proprietor, a corporation or an LLC. You may even deduct your new business vehicle in the first year if it is indeed used for business only. This does not apply for leased vehicles since you don’t own them. Also excluded is real estate, resale inventory, and property bought from a close relative. Sec. 179 deductions may not exceed your total taxable earnings. Other restrictions apply.

This provision is now permanent with the 2015 tax extender package. The modified bill also allows you to immediately deduct the cost for new HVAC systems, air conditioning and heating units placed in service after 1/1/2016. An additional 50% bonus depreciation beyond the Sec 179 spending cap is not permanent, but has been extended until 12/31/2019, with a phase-out dropping the bonus depreciation to 40% in 2018 and 30% in its last year 2019. More on Sec. 179 here.

18.) Home Office – Tax Deduction: As a landlord and real estate investor, similar to any small business owner, you may claim a home office deduction. You may deduct home office expenses equal to the proportionate size your dedicated home office takes up compared to your total home size. Your home office must be used regularly and exclusively for your business. Home office deductions may include proportionate mortgage payments, taxes and insurance, utility payments, phone, internet, etc. and must be related to your home office. You may not double deduct (!), e.g. your mortgage deduction and property taxes for your principal home and again for your home office. Accurately establish your home office size in relation to your home size. Restrictions apply and home office deductions can be red flags for IRS audits. Make sure to keep meticulous records.

19.) Sec. 45L New-Home Energy Efficiency – Tax Credit: If you are not just a real estate investor, but a real estate developer / new-home builder, you may claim a $2,000 tax credit for building energy efficient residences exceeding energy standards (heating and cooling) by 50%. This provision has been extended until 12/31/2016.

20.) Sec. 179D Energy Efficient Commercial Buildings – Tax Deduction: If you own commercial real estate and or multifamily apartment buildings, you may deduct up to $1.80 per square foot, if the building exceeds energy efficiency requirements under ASHRAE 2007. Restrictions apply. This provision has been extended until 12/31/2016.

21.) Property Loss – Tax Deduction: If your investment property suffers sudden damage or destruction from fire, flood, theft or vandalism, aka ‘casualty loss’, you may claim a tax deduction depending on the extend of loss and if the loss was not covered by insurance. Restrictions apply.

22.) Sec. 1031 Exchange – Tax Deferral: This is a huge powerful tool for savvy real estate investors! Any gain on the sale of investment property is normally subject to debilitating capital gains taxes plus the often overlooked depreciation recapture tax, unless you take advantage of a 1031 tax deferred exchange, aka Starker exchange.

To understand the tax savings, let’s look at current tax rates depending on the property’s holding period:

a.) Gains on investment properties sold within 1 year of purchase are subject to short term capital gains taxes, the same rate your ordinary income is taxed.

b.) Gains on investment properties sold after 1 year of purchase are subject to long-term capital gains taxes, a much more favorable tax rate.

Exhibit 2. – shows marginal capital gains tax rates: a.) short term (same as your income tax rate), and b.) long term, for respective 2016 income brackets.

Exhibit 2. – shows marginal capital gains tax rates: a.) short term (same as your income tax rate), and b.) long term, for respective 2016 income brackets.

Besides capital gains tax the depreciation recapture tax gets added to the tax bill. This is the tax on all the depreciation you were allowed to deduct on your tax returns. The depreciation recapture is taxed at your ordinary income tax rate, but is capped at a top 25% rate. For most of you real estate investors it will end up being 25%, and not less.

Remember in our depreciation example in Part 2, par 1.) above, you were able to deduct $610,000 over 27.5 years and not pay any tax on it. All of the depreciated $610,000 at time of sale is subject to the recapture tax, at least up to the limit that you have actual gains on the sale of your property. Means if your gain at time of sale is less than the amount you were able to depreciate over your holding period, than you may only pay recapture tax on the amount equal to the actual gain realized.

Btw, the recapture tax is applicable even if you failed to actually take the depreciation deduction! Double bummer. You can see that a big chunk of your gains can quickly disappear, unless you know how to get around it by taking advantage of the ingenious 1031 exchange.

A properly structured 1031 exchange is one of the finest tools available for real estate investors to build substantial real estate portfolios and long term wealth by deferring both, capital gains tax and recapture tax!

With tax deferral, real estate investors may re-balance their investment portfolio and improve cash flow, increase leverage, improve appreciation potential, trade up into better quality properties and reduce maintenance or management costs. An exchange may also create new depreciation deductions (see par 1.) to the degree of added value difference between both properties for an after tax net cash flow benefit – a nice bonus in particular if the relinquished property had already been fully depreciated. You could be trading up via 1031 exchanges as often as you like, rolling your equity into ever bigger and better deals all while never paying the tax, unless a.) you finally cash out, or b.) until you die. Upon death your real estate will be inherited by your heirs at the stepped up basis eliminating both, all the deferred capital gains and recapture tax.

Here are the basic 1031 exchange rules: A real estate investor may defer capital gains tax and recapture tax by selling one or more investment properties and purchase one or more ‘like kind’ investment properties at equal or greater value. ‘Like kind’ means, both the relinquished (sold) and replacement (bought) properties need to be investment properties (must show on tax return schedule E) and must be located within the US. Disqualified are your principal residence and your 2nd home or vacation home.

After the sale and recordation of the relinquished property you have a maximum of 45 days to identify one or several replacement properties and a maximum of 180 days to close on the replacement properties. A third party qualified intermediary is required to hold all sales proceeds in the interim and will prepare the exchange documents. You may also reverse the exchange order: buy first and sell second, aka a reverse 1031 exchange.

1031 exchanges can be tricky and additional rules and restrictions apply to qualify for successful tax deferral. Make sure you get all the fine details correct because a failed exchange could be detrimental to your financial growth.

23.) Rental Income – Self-Employment Tax / FICA Tax Exemption: If you are self-employed your earned income is usually subject to a 15.3% self-employment tax. If you are employed the tax usually shows as FICA (Federal Insurance Contribution Act) tax on your W-2 form, which is the 15.3% split 50/50 between you and your employer.

Rental income is not considered earned income (except when RE income flows through a C-corp), therefore generally exempt from the self-employment / FICA tax. One more reason why owning real estate and collecting rent is better than earned income.

24.) Sec. 469 Qualified Real Estate Professionals – Unlimited Tax Deduction: All above deductions including the huge depreciation deduction quickly amount to big money savings and could easily offset and exceed your rental income making it virtually tax free. Often deductions and depreciation create sizable paper losses to even offset a portion of your ordinary working income. Remember, paper losses are good and reduce your overall tax obligation. The more the better, except your allowable losses are limited to $25K per year for married couples filing jointly up to $100K modified gross income. Allowable losses phase out above $150K modified gross income. But, you may carry any unused losses including unused depreciation forward for years until you can, even until the day you sell your property! Then you may use all deferred paper losses to offset taxes and possibly even eliminate the need to do a 1031 exchange. Nice!

But we saved the best for last. For some of you most ambitious dedicated real estate investors, the sky is the limit! Sec. 469 eliminates the $25K annual loss cap and allows you to claim unlimited paper losses! To be able to claim unlimited losses as a Qualified Real Estate Professional you must meet certain criteria:

- You must spend more hours in real estate activities on an annual basis than in any other business.

- You must be actively involved in real estate activity for a minimum of 750 hours per year.

As married couple filing joint tax returns, either spouse may satisfy these requirements. You might be surprised to know that you do not have to be a licensed realtor. Qualified real estate activity includes real estate development, re-development, building, restoration, remodeling, buying and selling, converting, renting, managing and operating real estate.

Make sure to keep accurate records of time allocated to your real estate activity, as well as time allocated to other business activity. Other restrictions apply. Be careful, claiming Sec. 469 unlimited deductions can often be a red flag for IRS audits and you will need to document and support your material involvement to justify your eligibility.

Hopefully we inspired you to delve further into real estate tax benefits. Also check this IRS page.

Disclaimer: I’m a licensed real estate broker and personally completed a number of 1031 exchanges, as well as assisted many real estate investors with growing their respective real estate portfolios. However, I’m not a professional tax adviser. For tax matters always check with your favorite qualified tax professional.

We love to hear from you. – Please share, like and comment below.

The post Real Estate – Tax Benefit Guide appeared first on Honolulu HI 5 Blog.